Business

$847M Scam? Nigerians Lose ₦1.3 Trillion as CBEX Promised 100% ROI

CBEX has crashed after moving over $847M (₦1.3T) into a private ETH wallet, leaving users’ balances at 0.00.

CBEX has crashed after moving over $847M (₦1.3T) into a private ETH wallet, leaving users’ balances at 0.00.

Now they’re asking for $100–$200 “verification” fees to access funds that likely never existed.

The controversial AI trading platform, CBEX, is currently trending across social media platforms after it officially crashed, wiping out investor funds and sparking nationwide outrage.

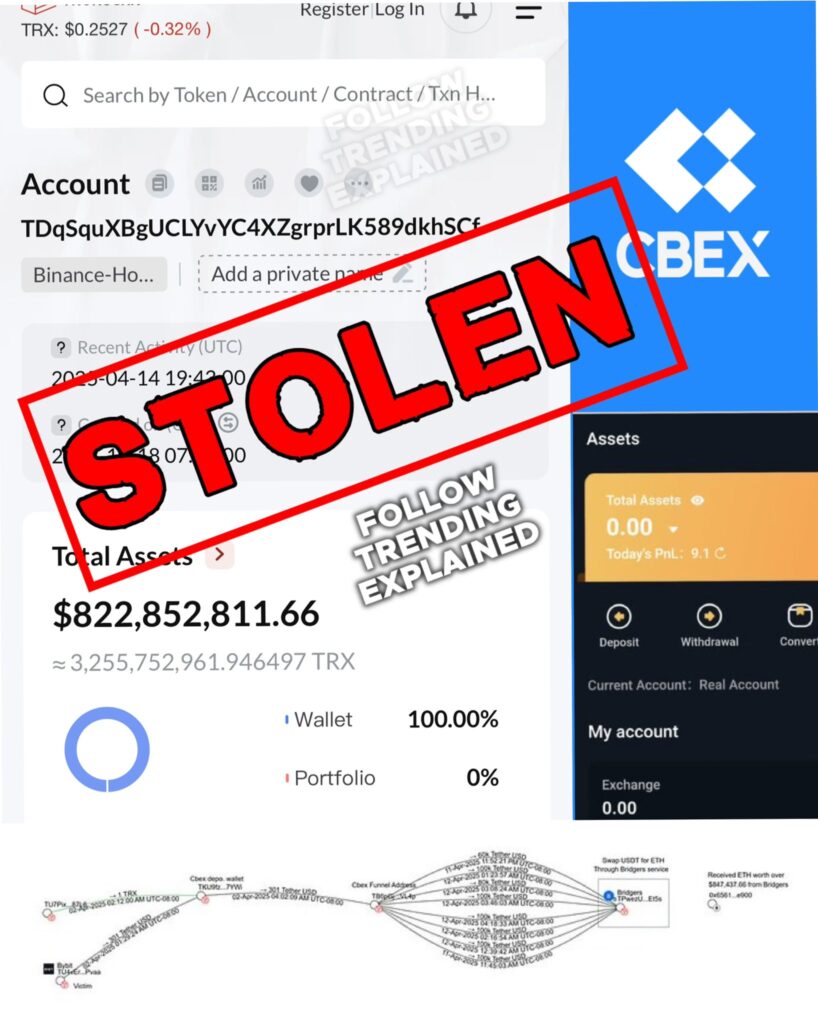

According to blockchain tracking, a total of $822,852,811.66 (₦1.337 trillion) was moved into a private Ethereum (ETH) wallet over the weekend. The funds, largely contributed by unsuspecting Nigerians, disappeared from user dashboards, which now show a balance of 0.00.

What’s more damning: The platform reportedly drained users’ wallets instantly upon deposit—not just today, but for weeks now—indicating this collapse was carefully orchestrated.

Telegram Channels Locked, Withdrawals Postponed

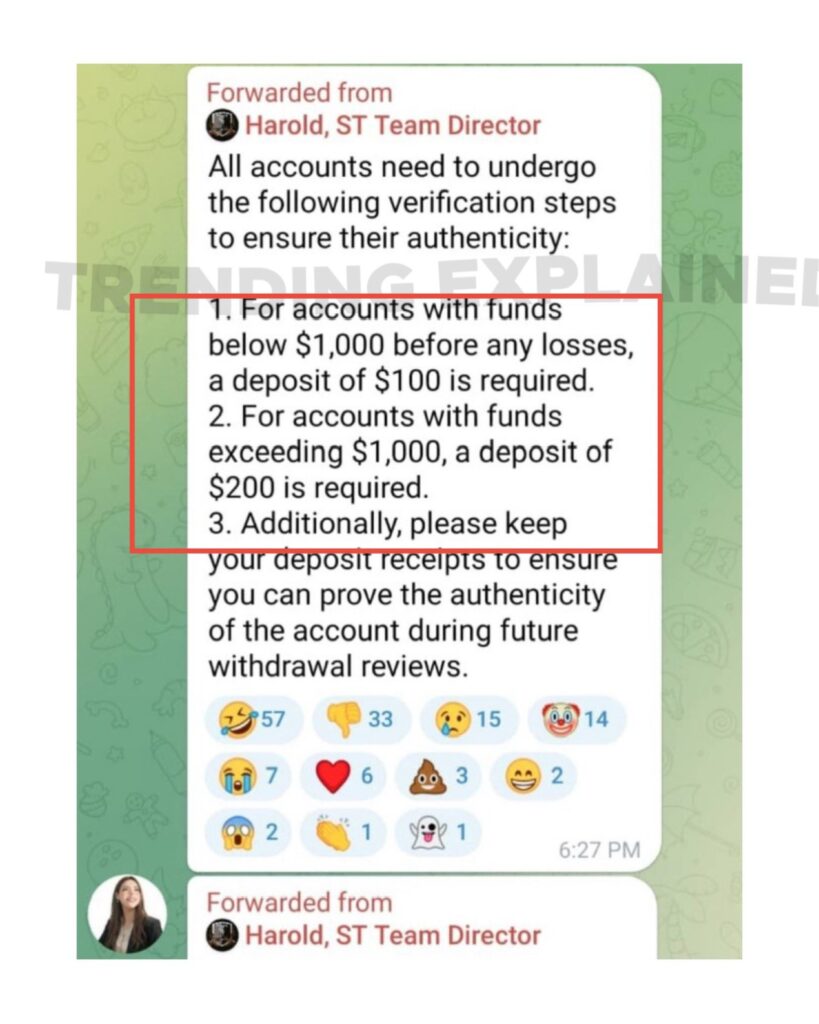

In response to the chaos, CBEX shut down all Telegram groups, blocked comments on social media, and postponed all pending withdrawals. But in a bizarre twist, the company is now asking users to pay “verification” fees to retrieve their lost funds:

- Users with over $1,000 are to pay $200

- Users with less than $1,000 are to pay $100

CBEX claims it suffered a “security breach” and will use these new funds to verify identities and authenticate withdrawals.

Red Flags Were Everywhere

CBEX promised 100% return on investment (ROI) in just 30 days through its supposed AI trading bot. But analysts now say there was never any real trading happening.

Security experts explain that CBEX’s backend was deliberately weak. When users made deposits into TRX wallets, the funds were instantly converted into USDT, then ETH, and routed to a single Ethereum wallet. All user dashboard activity was fabricated, including “daily trading” logs and “ROI calculations.”

DON’T MISS: My Husband Makes Love From Midnight Till Dawn’ — Kaduna Woman Seeks divorce

In reality, withdrawals were funded using new investor deposits—a textbook Ponzi scheme. This model mirrors the infamous MMM pyramid scheme that devastated Nigerian households in the past.

“The red flags are no longer flying. They’re walking, running and dancing,” quipped one analyst

The Wallet Trail

According to a detailed analysis by Taiwo Owolabi, a blockchain security researcher, the crypto wallet used by CBEX has already received over $847 million in USDT, and the number is still growing. The funds remain active and traceable at:

TRX address: TDqSquXBgUCLYvYC4XZgrprLK589dkhSCf

Can the Funds Be Recovered?

Experts say recovery is possible, but it would involve expensive legal, cybersecurity, and cross-border cooperation. CBEX is not licensed, and its entire operation mimicked the design of legitimate platforms like ByBit to gain credibility.

What Happens Now?

For many Nigerians, this is another painful reminder of the risks of unregulated platforms. As users scramble to decide whether to pay the new “verification fee,” critics warn: the cycle is only repeating itself.

“All you money is gone – unless you pay them again, so they can pay someone else,” on user lamented.

See pictures below:

You must be logged in to post a comment Login