Business

Relief for Nigerians as Dangote Slashes Petrol Price

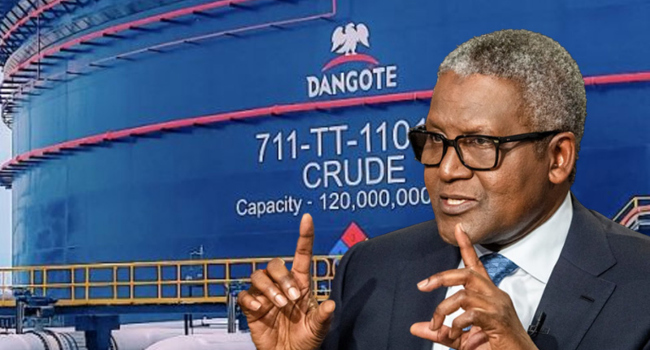

Nigeria’s Dangote Refinery has cut its ex-depot petrol price from N828 to N699 per litre…

- Nigeria’s Dangote Refinery has cut its ex-depot petrol price from N828 to N699 per litre — its biggest reduction yet — triggering nationwide market shifts and intensifying pressure on fuel importers already battling shrinking margins.

Nigerians may finally experience some respite from high fuel costs as the Dangote Refinery announced a major petrol price reduction, slashing its ex-depot rate to N699 per litre effective December 11.

The sharp drop from N828 per litre marks a 15.58% reduction, becoming the refinery’s 20th price adjustment this year. But while consumers celebrate, the development has intensified pressure on traditional fuel importers and depot operators caught in a pricing war that has disrupted the downstream petroleum landscape since late 2024.

Industry insiders warn that many private depots — already facing eroded profit margins — may struggle for survival as Dangote’s 650,000-barrel-per-day plant continues to leverage its massive refining capacity to set market direction.

In rapid response, several depots aligned with the new benchmark. Sigmund Depot trimmed its ex-depot rate by N4, while TechnoOil opted for a steeper N15 reduction.

“The margins are shrinking by the day,” a Lagos-based fuel distributor, Tosin Akinbobola, told reporters on condition of anonymity. “Dangote operates on a different scale entirely. Matching those prices would put many of us at a loss.”

Despite rising domestic refining output, Nigeria imported 2.28 billion litres of petrol between January and March 2025, amounting to $1.26 billion in forex spending, according to Central Bank data — a sign of the complex transition between old import-dependent structures and the new refinery-driven system.

The latest reduction comes just days after Dangote met President Bola Ahmed Tinubu on December 6, reaffirming his commitment to keeping fuel prices competitive despite global market volatility and persistent cross-border smuggling.

“Prices are going down. We have to compete with imports,” Dangote said after the meeting, noting that Nigeria’s pump price remains far below neighbouring countries, where petrol retails between N1,500 and N1,600 per litre.

The refinery’s adjustment has triggered a ripple effect across the downstream sector. Private depots such as A.A. Rano, NIPCO, and Aiteo have begun adopting the new pricing structure. NNPC Limited has also reduced pump prices twice within the last two weeks, with Abuja retail rates now fluctuating between N915 and N937 per litre.

Analysts say the frequent adjustments signal a structural shift in Nigeria’s petroleum market, with the long-standing marketers’ consortium model giving way to direct negotiations between individual operators and the refinery. This change is accelerating price alignment and improving supply consistency.

With a $19 billion investment, Africa’s largest refinery has capacity far exceeding Nigeria’s domestic demand, positioning it to stabilise the fuel market and end decades of scarcity cycles that have plagued the country since the 1970s.

Company officials say the new price is targeted at easing transport costs and reducing economic strain ahead of the festive season. Filling stations are expected to sell as low as N600 per litre in some states — a significant shift for consumers who have endured steep petrol prices throughout 2025.

Transport operators, logistics companies, and millions of everyday commuters are projected to feel the impact almost immediately, with lower fares anticipated during the peak holiday travel period.

Industry observers say that while Nigeria’s import-driven fuel economy is far from dead, Dangote’s aggressive pricing signals an irreversible transformation — one that is reshaping the sector and redefining the market power dynamics of Africa’s largest economy.