News

Step-by-Step Guide: How to Apply for Tax ID to Operate Bank Accounts in Nigeria

From January 1, 2026, every taxable Nigerian must have a Tax Identification Number (TIN) to operate bank accounts.

- From January 1, 2026, every taxable Nigerian must have a Tax Identification Number (TIN) to operate bank accounts. Taiwo Oyedele of the Presidential Tax Reforms Committee explains the new process and requirements.

Starting January 1, 2026, every taxable Nigerian will be required to obtain a Tax Identification Number (TIN) or Taxpayer Identification Number to operate bank accounts in the country. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, disclosed the regulatory overhaul in a recent interview shared on his X account on December 10, 2025.

The move is part of the government’s broader tax administration reforms aimed at expanding the national tax net. Oyedele clarified that the enforcement is backed by Section 4 of the Nigerian Tax Administration Act (NTAA), which legally mandates all taxable persons to register for a TIN.

“A taxable person is anyone who earns income through trade, business, or any economic activity. So banks must request a tax ID from taxable persons,” Oyedele explained.

What is a Tax Identification Number (TIN)?

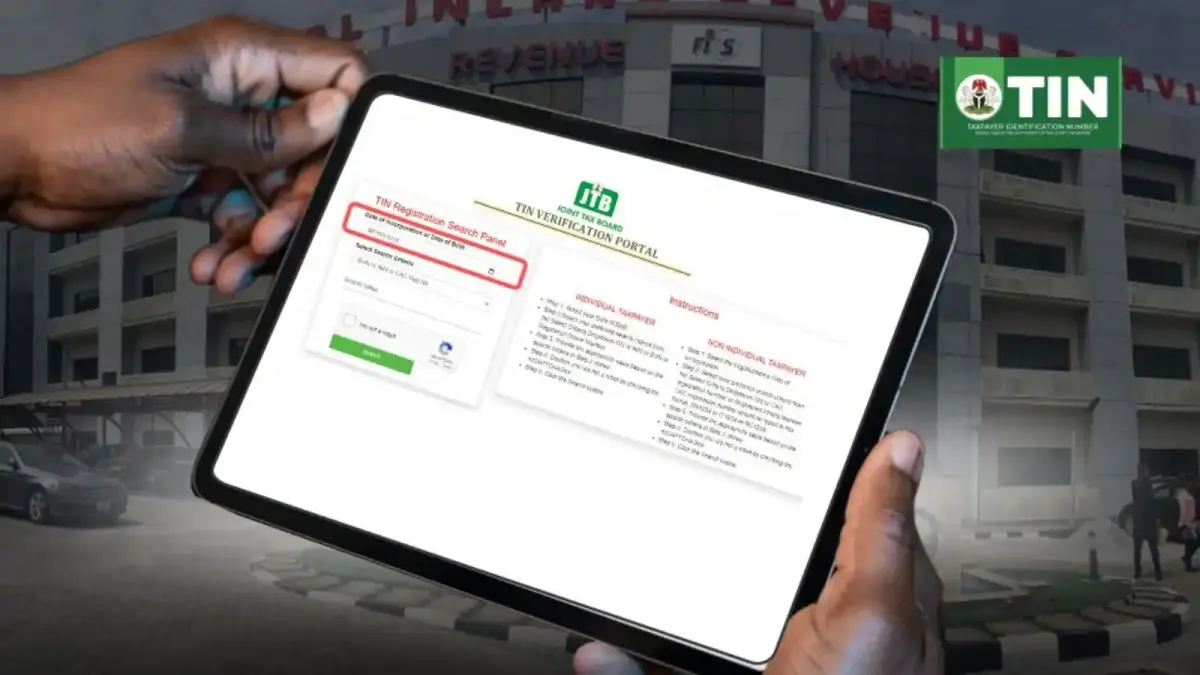

A Tax ID is a unique identifier used to track tax activities of individuals and businesses. It ensures proper recording of tax payments, simplifies filing returns, and serves as proof of compliance. Under the new harmonized system, an individual’s National Identification Number (NIN) or a company’s Corporate Affairs Commission (CAC) registration number will serve as their TIN.

DON’T MISS: Bishop Oyedepo Speaks on Joining Politics If Offered $1 Billion

Step-by-Step Guide to Apply for Your Tax ID:

- Visit the JTB Portal: Go to tin.jtb.gov.ng.

- Select the Relevant Section: Choose the applicable category (individual or business).

- Enter Your NIN: For individuals, the National Identification Number serves as the TIN.

- Fill in Basic Information: No biometrics or physical card is required.

- Submit and Receive Your Tax ID: The Tax ID is usually generated within 48 hours.

Tax ID for Businesses:

- Small unregistered businesses can use their personal Tax ID.

- Incorporated companies receive a TIN automatically upon CAC registration.

- Companies must visit an FIRS office with original and copied registration documents. Sole proprietors may also need to register for VAT, linking it to their TIN.

Costs and Safety:

Applying for a Tax ID is free if done directly by the individual or business. Third-party services may charge a fee. Oyedele assured Nigerians that the new law does not allow the government to withdraw money from bank accounts. “Nobody will debit the accounts. Even if you have N1 billion, nobody can debit your bank account,” he said.

The reforms also raise the reporting threshold from N10 million to N25 million, meaning approximately 98% of bank account holders are unaffected.

Purpose of the Reform:

The changes aim to simplify taxation, broaden compliance, and support economic stability. By unifying identifiers, the government hopes to reduce duplication and make tax administration more transparent.