Business

BREAKING: Nigeria’s FX Reserves Hit $46bn for First Time Since 2018

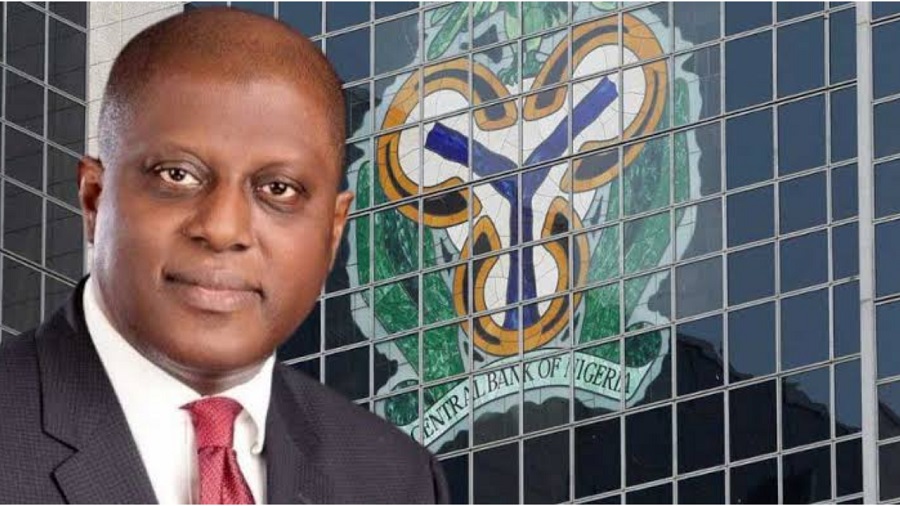

Nigeria’s foreign exchange reserves have surged past $46 billion, marking the highest level since 2018, according to CBN Governor Olayemi Cardoso.

- Nigeria’s foreign exchange reserves have surged past $46 billion, marking the highest level since 2018, according to CBN Governor Olayemi Cardoso.

Nigeria’s foreign exchange (FX) reserves have surged to over $46 billion, marking the first time since 2018 that the country has reached such a level, according to Olayemi Cardoso, governor of the Central Bank of Nigeria (CBN).

Cardoso—represented by Muhammad Abdullahi, deputy governor in charge of Economic Policy—disclosed the development during the opening session of the monetary policy department’s 20th anniversary colloquium at the CBN headquarters in Abuja on Tuesday.

He said the current reserve level provides more than 10 months of import cover, strengthening Nigeria’s external position and signalling improved confidence in the economy.

Cardoso also hinted that lending rates may begin to fall in the coming months as inflation shows signs of easing. This, he noted, could enhance access to credit and stimulate stronger investment inflows across key sectors.

DON’T MISS: BREAKING: CBN Governor Olayemi Cardoso Given 7 Days to Explain Missing N3 Trillion Public Funds

Checks on the CBN website confirmed that the $46 billion threshold was reached on November 14.

However, the achievement comes amid continued volatility in the FX market. At the official Nigerian Foreign Exchange Market (NFEM), the naira depreciated to ₦1,448.03 per dollar on Monday, compared to ₦1,442.43 recorded on November 14.

In contrast, the parallel market saw a slight recovery as the naira appreciated to ₦1,455/$ on Monday, strengthening from ₦1,457/$ last Friday.

Cardoso added that just a month ago, the reserves had climbed to a five-year high of $43.4 billion, providing 11 months of import cover at that time. He attributed the continued growth to the clearing of FX backlogs and improved liquidity across the market.