Business

BREAKING: CBN Issues New Directive, Imposes 0.5% Cybersecurity Levy On Nigerians

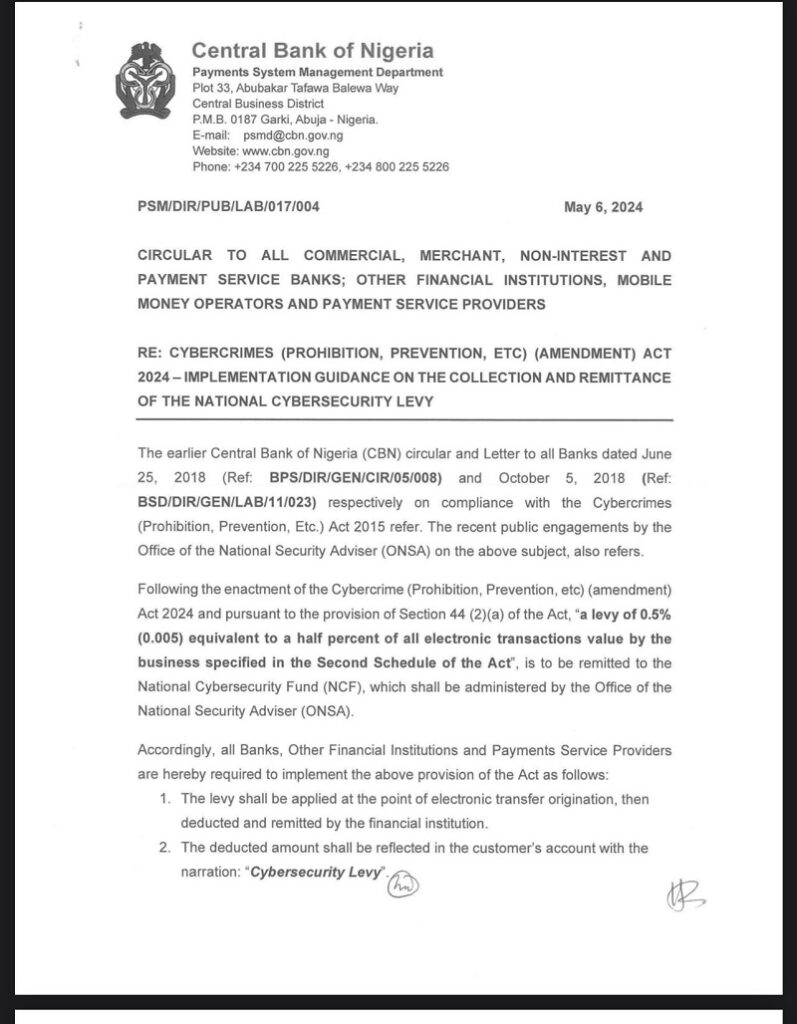

The Central Bank of Nigeria has directed banks to implement a 0.5% cybersecurity levy on transactions.

The Central Bank of Nigeria has directed banks to implement a 0.5% cybersecurity levy on transactions.

A notice issued by the central bank on Monday revealed that the levy’s enforcement is scheduled to commence in a fortnight from today.

The notice included all commercial banks, merchant banks, non-interest banks, and payment service banks, among others.

The Central Bank of Nigeria (CBN) has directed banks to implement a 0.5% cybersecurity levy on transactions.

VerseNews gathered that CBN introduced this levy, effective in two weeks, in response to rising cybercrime threats targeting financial institutions.

In a circular issued by the apex bank on Monday, it was revealed that the levy’s enforcement is scheduled to commence in a fortnight from today.

The circular included all commercial banks, merchant banks, non-interest banks, and payment service banks, among others.

“Following the enactment of the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024 and pursuant to the provision of Section 44 (2)(a) of the Act, ‘a levy of 0.5% (0.005) equivalent to a half percent of all electronic transactions value by the business specified in the Second Schedule of the Act,’ is to be remitted to the National Cybersecurity Fund, which shall be administered by the Office of the National Security Adviser,” the circular read in part.

This Online News Platform gathered that the levy, mandated by the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024, aims to fund the National Cybersecurity Fund managed by the Office of the National Security Adviser.

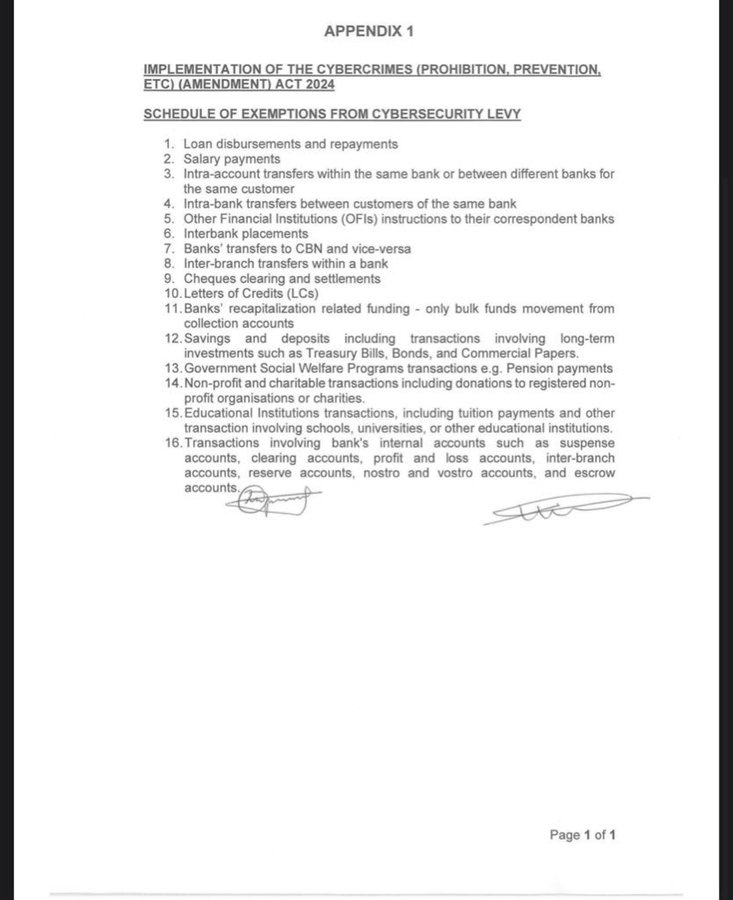

It applies to various electronic transactions but exempts certain categories like loan disbursements, salary payments, and inter-bank transfers.

However, there are list of exemptions from cybersecurity charges, they are:

1. Loan disbursements and repayments

2. Salary payments

3. Intra-account transfers within the same bank or between different banks for the same customer

4. Intra-bank transfers between customers of the same bank

5. Other Financial Institutions (OFIs) instructions to their correspondent

6. banks Interbank placements

7. Banks’ transfers to CBN and vice-versa

8. Inter-branch transfers within a bank

9. Cheques clearing and settlements

10. Letters of Credits (LCs)

11. Banks’ recapitalization related funding – only bulk funds movement from collection accounts

12. Savings and deposits including transactions involving long-term investments such as Treasury Bills, Bonds, and Commercial Papers.

13. Government Social Welfare Programs transactions e.g. Pension payments

14. Non-profit and charitable transactions including donations to registered nonprofit organisations or charities.

15. Educational Institutions transactions, including tuition payments and other transaction involving schools, universities, or other educational institutions.

16. Transactions involving bank’s internal accounts such as suspense accounts, clearing accounts, profit and loss accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts

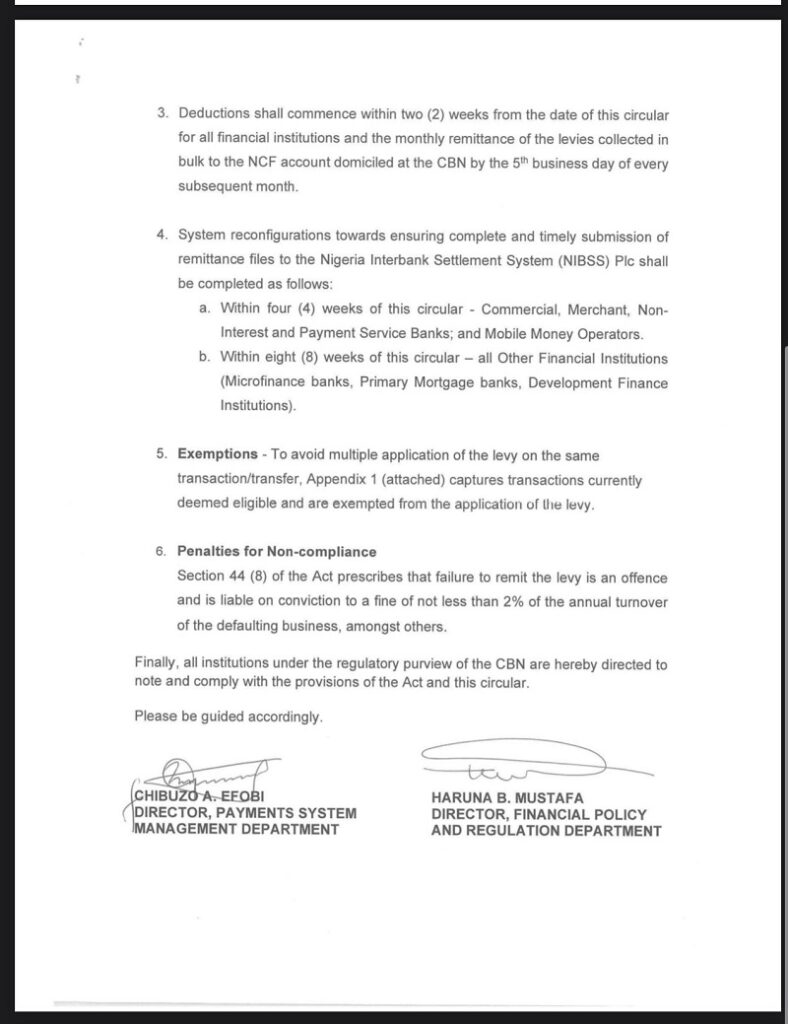

While proponents argue it’s necessary for cybersecurity, critics fear it might discourage cashless transactions and affect financial inclusion efforts. The CBN warns of penalties for non-compliance, including fines up to 2% of the defaulting business’s annual turnover.

See circular for the cybersecurity levy below: