Business

CBN Confirms 16 Banks Fully Meet Capital Requirements, Recapitalisation Progresses

The Central Bank of Nigeria (CBN) has confirmed that 16 commercial banks have fully met the revised regulatory capital requirements.

- The Central Bank of Nigeria (CBN) has confirmed that 16 commercial banks have fully met the revised regulatory capital requirements, reflecting progress in the ongoing recapitalisation programme.

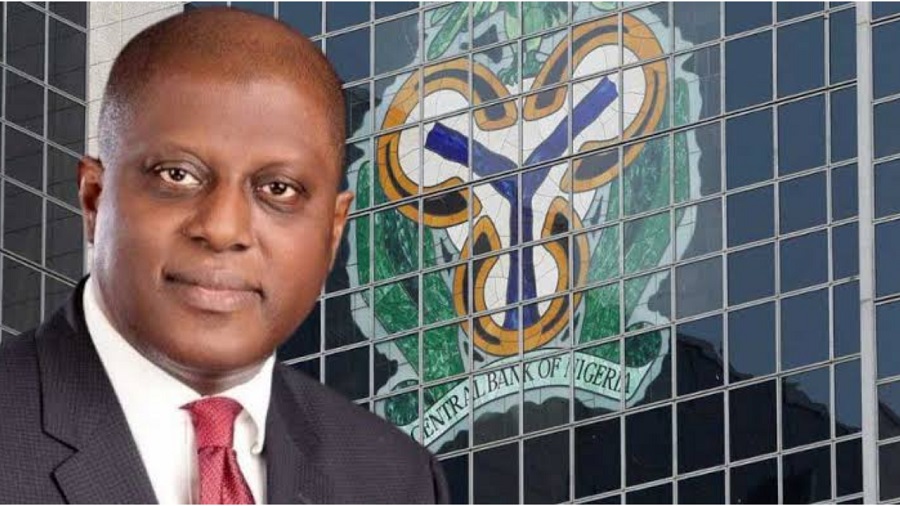

CBN Governor Olayemi Cardoso made the announcement on Tuesday during a press briefing following the 303rd Monetary Policy Committee (MPC) meeting in Abuja. He stated that the committee expressed satisfaction with the banking sector’s resilience, noting that most financial soundness indicators remain within regulatory thresholds.

“Members also acknowledged the substantial progress in the ongoing recapitalisation program, with 16 banks achieving full compliance with revised capital requirements,” Cardoso said.

Banks Raising Capital to Strengthen Financial Buffers

According to the governor, 27 banks have taken steps to raise capital through various channels, with the aim of enhancing their financial buffers and building a banking sector capable of effectively supporting Nigeria’s economy.

“16 of them have fully complied. 27 of them have, through various means, raised capital. We are monitoring the developments and from every indication, it is going in the right trajectory,” he said.

Cardoso emphasized that the recapitalisation process is critical to ensuring that Nigerian banks remain competitive both domestically and across the African continent, while also managing risks in multiple markets.

“Many of you will also know that many of our banks are out on the African continent, and they have been innovative in various fairs,” he added. “These buffers that they are creating will help them navigate risks in the multiplicity of countries in which they operate, which ultimately benefits Nigerian traders and individuals.”

DON’T MISS: BREAKING: CBN Holds Interest Rate At 27%

Background: Rising Minimum Capital Requirements

On March 28, 2024, the CBN increased the minimum capital requirement for commercial banks with international licences to N500 billion. Several banks subsequently raised funds through rights issues and bond issuances to comply.

Notable examples include Zenith Bank, which raised N350.46 billion through a rights issue and public offer, and Guaranty Trust Holding Company Plc (GTCO), which successfully priced its fully marketed offering on the London Stock Exchange.

Earlier in September, Cardoso reported that 14 banks had fully met their recapitalisation requirements, up from eight in July, reflecting steady progress in the sector’s strengthening efforts.

The CBN continues to monitor the developments closely, ensuring that the recapitalisation programme strengthens the banking sector and positions it for long-term growth.