Business

Tinubu Approves NTPIC to Supervise Implementation of Major Tax Reforms

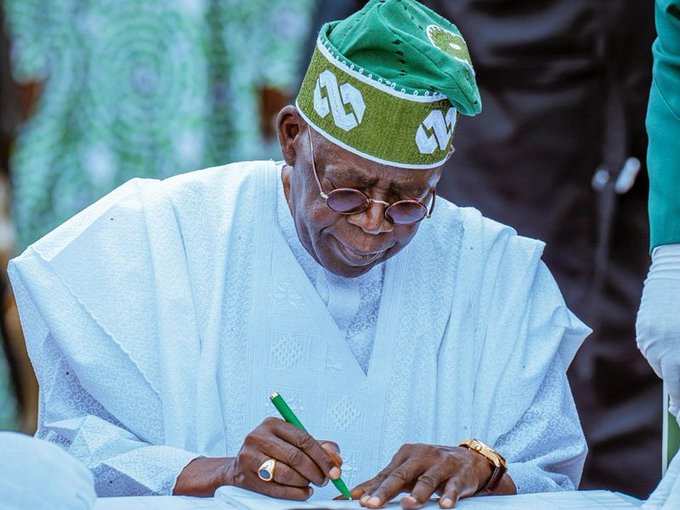

President Bola Tinubu has inaugurated the National Tax Policy Implementation Committee to coordinate the rollout of Nigeria’s sweeping new tax reforms …

- President Bola Tinubu has inaugurated the National Tax Policy Implementation Committee to coordinate the rollout of Nigeria’s sweeping new tax reforms and strengthen revenue mobilisation.

President Bola Tinubu has inaugurated a National Tax Policy Implementation Committee (NTPIC) to ensure the effective rollout of Nigeria’s newly enacted tax reforms.

According to a statement issued on Friday by presidential spokesperson Bayo Onanuga, the committee will be chaired by Joseph Tegbe and supervised by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The NTPIC is mandated to engage key stakeholders across both public and private sectors, ensuring seamless implementation of the new tax laws. Tinubu emphasised that proper execution of the reforms is critical to his administration’s economic transformation agenda, particularly in strengthening public finance and protecting investor confidence.

The committee includes the Special Adviser to the President on Finance and Economy, Mrs. Sanyade Okoli, who will serve as Secretary, along with Ismaeel Ahmed, Rukaiya El-Rufai, and other experts drawn from finance, law, and civil society.

Tinubu noted that the new tax framework is designed to build a fair, transparent, and modern system capable of boosting growth while safeguarding citizens and businesses. The NTPIC will focus on nationwide consultations, public sensitisation, improved coordination among government agencies, and measures that curb leakages and enhance revenue.

The committee is expected to strengthen accountability, enhance fiscal sustainability, and support Nigeria’s long-term development objectives.

This comes after the federal government officially gazetted Nigeria’s new tax reform laws, marking what it described as a historic overhaul of the nation’s fiscal structure. The reforms — signed into law by President Tinubu on June 26, 2025 — introduce updated structures for taxation, administration, and revenue collection.

DON’T MISS: CBN Confirms 16 Banks Fully Meet Capital Requirements, Recapitalisation Progresses

According to an earlier statement by Kamorudeen Yusuf, Personal Assistant to the President on Special Duties, the new fiscal regime is anchored on four key legislations:

- Nigeria Tax Act (NTA), 2025

- Nigeria Tax Administration Act (NTAA), 2025

- Nigeria Revenue Service (Establishment) Act (NRSEA), 2025

- Joint Revenue Board (Establishment) Act (JRBEA), 2025

The administration said the reforms aim to simplify the tax system, support small businesses, attract investment, and improve fiscal stability in line with Tinubu’s Renewed Hope Agenda to diversify revenue beyond oil.