Business

Why Dangote Refinery Withdraws ₦100 Billion Lawsuit Against Oil Marketers, NNPC

Dangote Refinery has withdrawn its ₦100 billion lawsuit against NNPC Ltd and oil marketers, sparking speculation of an out-of-court settlement.

Dangote Refinery has withdrawn its ₦100 billion lawsuit against NNPC Ltd and oil marketers, sparking speculation of an out-of-court settlement.

The case, which challenged import licenses allegedly undermining local refining under the Petroleum Industry Act, was quietly discontinued in July 2025.

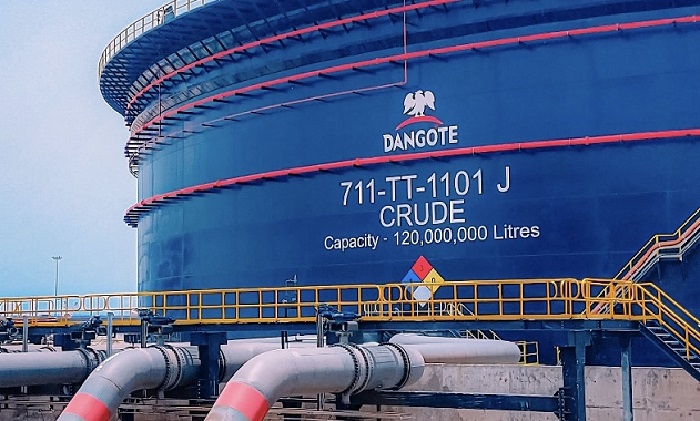

The Dangote Petroleum Refinery and Petrochemicals has unexpectedly withdrawn its ₦100 billion lawsuit against the Nigerian National Petroleum Company Limited (NNPC Ltd), AYM Shafa Ltd, and A.A. Rano Ltd, sparking speculation across the oil and gas sector.

The case, originally filed in September 2024 at the Federal High Court in Abuja (Suit No. FHC/ABJ/CS/1324/2024), accused the defendants of undermining the Petroleum Industry Act (PIA) by importing petroleum products despite the commissioning of the 650,000-barrels-per-day Dangote Refinery.

Dangote argued that import licenses granted by the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) should only be issued in cases of local supply shortages, per Sections 317(8) and (9) of the PIA.

However, in a notice dated July 28, 2025, Senior Advocate of Nigeria (SAN) Ogwu James Onoja, counsel for Dangote Refinery, formally informed the court of the company’s decision to discontinue the case, stating simply:

“Take notice that the plaintiff herein discontinues this suit against the defendants forthwith.”

Industry insiders suggest the withdrawal may signal an out-of-court settlement, government intervention, or a strategic shift to maintain market relationships. Neither Dangote Group nor the defendants have publicly disclosed the reason behind the move.

DON’T MISS: Aliko Dangote Retires as Chairman of Dangote Cement, Announces New Successor

Previously, the defendants, represented by Ahmed Raji, SAN, described Dangote’s suit as an attempt to monopolise Nigeria’s petroleum market, insisting that the refinery alone could not meet the country’s fuel demand. Regulatory authorities also defended their decision, citing fuel security and market stability as priorities.

The abrupt withdrawal comes just weeks before the next court hearing scheduled for September 29, 2025, leaving stakeholders curious about the possible behind-the-scenes negotiations that led to this decision.

The development highlights the ongoing tension in Nigeria’s downstream sector as the government balances local refining ambitions, market liberalisation, and fuel import dependency.

You must be logged in to post a comment Login