Business

Moniepoint POS Charges List

Moniepoint POS Charges List: For withdrawals, they charge 0.5% for transactions under N20,000 and a flat N100 for higher amounts.

Moniepoint POS Charges List: For withdrawals, they charge 0.5% for transactions under N20,000 and a flat N100 for higher amounts.

Money transfers have a flat N20 fee. For Money transfer, You’ll be charges a flat fee of N20 regardless of the transfer amount.

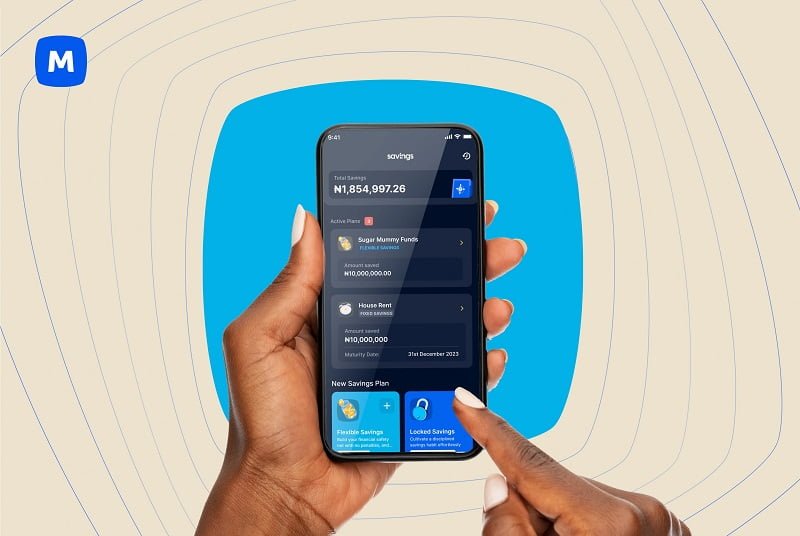

Moniepoint is a popular Point-of-Sale (POS) in Nigeria. Thanks to its reliability, user-friendly interface and competitive pricing. In fact, according to Moniepoint, there are over One Million active terminals. It offers a convenient way for businesses to accept cashless transactions.

However, it is important to note that before you sign up for Moniepoint POS, it is important to understand the fees associated with using the system.

After all, the last thing you want is to be hit with unexpected charges that eat into your profits. That’s why we have bring together a comprehensive list of Moniepoint POS charges, from setup fees to transaction costs.

With this information at your fingertips, you can decide whether Moniepoint POS is the right fit for your business. Let’s get to it!

List Of Moniepoint POS Charges

The list below contains all the transaction charges, including withdrawals, Money transfers, purchases, wallet funding, and payments.

1. Moniepoint Withdrawal Charges:

N1 – N20,000: This category benefits from a lower fee structure. Moniepoint charges a 0.5% percentage-based fee on the withdrawal amount. For example, if a customer withdraws N5,000, your fee would be N25 (0.5% x N5,000). This makes smaller withdrawals relatively inexpensive.

Above N20,000: For larger withdrawals exceeding N20,000, Moniepoint applies a flat fee of N100. It simplifies the cost calculation for high-value transactions.

2. Moniepoint Money Transfers Charges:

Moving money between accounts incurs a flat fee of N20 regardless of the transfer amount. It means you’ll only be charged a flat fee of N20 for money transfers to all banks in Nigeria. This provides a predictable cost for facilitating customer transfers.

3. Moniepoint Purchases Charges

There are no major charges for airtime, data, and other types of purchases. Rather, a commission is attached to them: 2% to 4.5% for PHCN tokens, 3% for MTN purchases, 4.5% for 9Mobile purchases, 4% for GLO purchases, and 4% for Airtel purchases.

4. Moniepont Wallet Funding Charges

There are also no charges attached to wallet funding, such as betting accounts. Only the amount you choose to fund will be deducted from your Moniepoint account; no other charges are attached.

5. Moniepoint ATM Card Charges

Moniepoint issues debit cards, which can be either a Mastercard or Verve card. If you need one for yourself, you can request it via the Moniepoint App or your Moniepoint business profile. The charge for the Moniepoint ATM card is N1500. With the Moniepoint card, you can carry out both online and offline transactions and make payments online.

6. Moniepoint POS Terminal Charges

The Moniepoint POS terminal cost a total of N21,500. This includes a caution fee of N10,000, a logistics fee of N10,000 and an Insurance fee of N1,500 for a whole year.

Additional Considerations:

- No Monthly Maintenance Fees: Unlike some POS providers, Moniepoint doesn’t charge a monthly/yearly fee for using their POS machine. This can be a major cost-saving for businesses, especially those with lower transaction volumes.

- Commissions on Bill Payments and Top-Ups: Moniepoint offers an opportunity to earn commission on specific services like bill payments for DSTV, GOTv, StarTimes, and data top-ups for major mobile networks (MTN, Glo, 9Mobile, Airtel).

These commissions vary by service provider and is a source of additional income for your business.

- Transaction Limits: It’s important to know any transaction limits Moniepoint imposes. These limits may be related to daily withdrawal amounts or maximum transfer sizes. Consult the Moniepoint website (https://moniepoint.com/) or customer service for current limitations.

Factors Affecting Moniepoint Charges

A. Transaction Type

As mentioned earlier, charges differ based on the type of transaction (withdrawal, money transfer). Understanding these distinctions helps you anticipate the costs associated with each service.

B. Transaction Amount

The fee structure for withdrawals changes depending on whether the amount falls within the N1-N20,000 bracket or surpasses N20,000.

The official Moniepoint website is a valuable resource for the latest information on their POS charges, commissions, and any potential updates to the fee structure.

Don’t hesitate to contact Moniepoint customer service directly if you have specific questions or need clarification on any aspect of their charges. They can provide the most up-to-date information and address any concerns you may have.

Note that despite paying for a Moniepoint POS, you don’t own it. Moniepoint can still reassign the terminal if you don’t consistently meet up with the daily target of N80,000 daily.

According to Moniepoint, “If your POS can’t hit this target, it is considered underperforming, and you risk it being reassigned.” If you can’t meet the target and the POS is retrieved, you’ll be paid N10,000 as a form of refund if the POS machine remains in great condition.

Moniepoint POS Charges List Vs Opay and Palmpay Charges List

| Service | Moniepoint POS | Opay POS | Palmpay POS |

| Withdrawal Charges | 0.5% of transaction amount (N1-N20,000).Flat Rate of N100 (above N20,000) | Varies based on transaction amount:₦1 to ₦1,000: ₦4.6 ₦1,001 to ₦2,000: ₦9.2 ₦2,001 to ₦3,000: ₦13.8 ₦3,001 to ₦4,000: ₦18.4 ₦4,001 to ₦5,000: ₦23 … (ascending increment) | 0.5% of transaction amount (capped at N100) |

| Transfer Charges | Flat Rate of N20 | Varies based on transaction amount: ₦1,000 to ₦5,000: ₦8.5 ₦5,001 to ₦10,000: ₦17 Above ₦10,000: ₦25.5 | Same as withdrawal charges (0.5% capped at N100) |

| Data Top-up | MTN: 3% commission Glo: 4% commission 9Mobile: 4.5% commission Airtel: 4% commission | MTN: 3% GLO: 4% 9 Mobile: 4.5% Airtel: 4% | MTN: 3% GLO: 4% 9 Mobile: 4.5% Airtel: 4% |

| TV Subscription | DSTv: 2% commissionGOTv: 2% commission PHCN: 2% commission Star Times: 2% commission | DSTV subscription: 2%GOTV Subscription: 2% | DSTV subscription: 2%GOTV Subscription: 2% |

FAQs: Moniepoint POS Charges List

1. What are the different types of fees associated with Moniepoint POS?

Moniepoint charges fees based on the type of transaction:

- Withdrawal fees: These vary depending on the withdrawal amount.

- Withdrawals below N20,000 incur a 0.5% fee.

- Withdrawals above N20,000 have a flat fee of N100.

- Money transfer fees: A flat fee of N20 applies to all money transfers, regardless of the amount.

2. Are there any monthly maintenance fees for using Moniepoint POS?

No, Moniepoint does not charge a monthly maintenance fee for using its POS machine. This is a major cost savings compared to other POS providers.

3. Can I earn additional income using Moniepoint POS?

Yes, Moniepoint offers commissions on specific services, such as bill payments (DSTV, GOTv, StarTimes) and mobile data top-ups for major networks (MTN, Glo, 9Mobile, Airtel). The commission rate varies by service provider.

4. Where can I find the latest information on Moniepoint POS charges and commissions?

There are two main resources to stay updated:

- Moniepoint website: Check their dedicated fees section or FAQs for the most recent information.

- Moniepoint customer service: Contact them directly for any questions or clarifications regarding current charges and commissions.

5. Are there any transaction limits for withdrawals or money transfers on Moniepoint?

Yes, Moniepoint POS has transaction limits for withdrawals and money transfers. These limits depend on whether the business owner has completed KnowYour Customer (KYC) verification.

- Business owners with full KYC: These business owners enjoy the same limits they have set on their regular Moniepoint profile for transfers and have a cumulative daily limit of N25 million (25,000,000 Naira).

- Business owners with pending KYC: These business owners have a maximum limit of N900,000 (900,000 Naira) per POS transfer and a cumulative daily limit of N5 million (5,000,000 Naira).

- How can I calculate the fee for a withdrawal?

- For withdrawals below N20,000: Multiply the withdrawal amount by 0.5%. (e.g., N5,000 withdrawal x 0.5% = N25 fee)

- A flat fee of N100 applies to withdrawals above N20,000

6. What happens if the Moniepoint POS charges change in the future?

The information in this article reflects current charges. However, it may be subject to change at any time. It’s recommended to regularly check the Moniepoint website or contact customer service for any updates to the fee structure.

7. How Much is a Moniepoint ATM Card?

The Moniepoint ATM card costs N1500. You must have funded your account with at least N1500 to request the card.

8. How Much is MoniePoint POS?

The Moniepoint POS terminal costs N21,500. N10,000 for the caution fee, N10,000 for the logistics fee, and N1500 for the insurance fee for a whole year.

Moniepoint Contact Phone Numbers and Email

Should you have any enquiry to make about Moniepoint Charges list, you can contact Moniepoint via any of the below listed means:

- Email at info@moniepoint.com or support@moniepoint.com.

- You can also contact Moniepoint by phone at 0201 888 9990.

- Address: The Post Square, Off Adeola Odeku, Victoria Island, Lagos, Nigeria

Moniepoint’s expert staff are available 24/7 to help.

Moniepoint’s POS system offers competitive transaction fees. There is a clear distinction between withdrawal charges based on amount and a flat fee for money transfers. The absence of monthly maintenance fees is an added benefit.

Moniepoint POS provides a reliable and user-friendly system that can help businesses manage transactions effectively. Now that you have all the information you need about the Moniepoint POS charges list, you can make informed decisions about using Moniepoint POS for your business needs.

Do you have any more information to share about the topic of this article? Let me know about it in the comments box. Subscribe to this website to read more articles like this. Thank you!

You must be logged in to post a comment Login